Table of Content

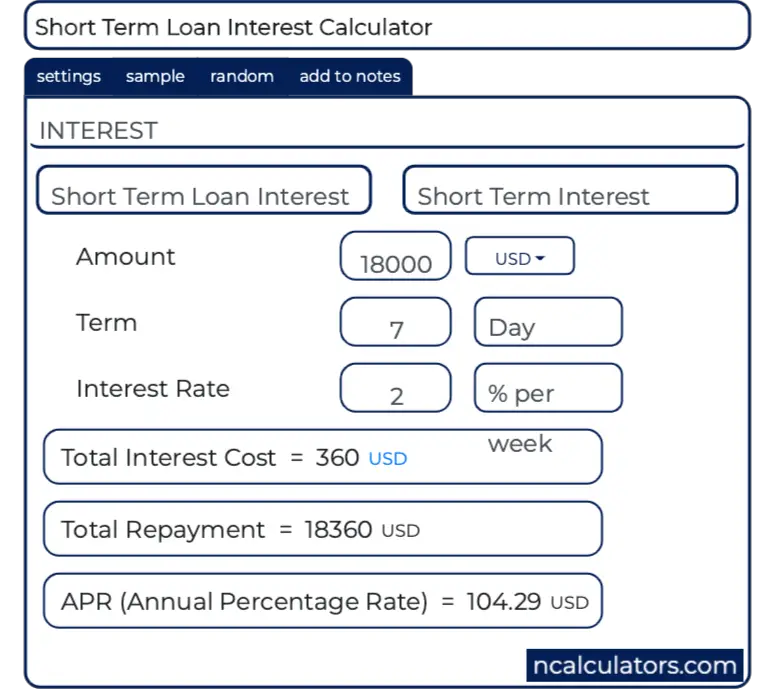

The results from this calculator should be used as an indication only. Results do not represent, quotes, pre-qualifications for any product or an offer to provide credit. Information such as interest rates quoted and default figures used in the assumptions are subject to change. Compare your loan amount with other factors to estimate your loan repayments. In five steps our free and independent home loan repayment calculator tallies your minimum monthly, fortnightly or weekly mortgage repayments. Enter your income, expenses, other financial commitments and mortgage details to use the calculator.

RAMS mortgage calculators can give you an estimate of what your repayments could be, based on your home loan amount, your loan type and the interest rate you think you'll be paying. In addition to income, lenders consider your deposit size, debts and liabilities and credit history. One way a potential borrower demonstrates their ability to make repayments is through their deposit size.

All calculators

Repayments are based on a standard interest rate and principle payment schedule with a constant interest rate for the term of the loan. To give you a better idea of what you may be able to borrow we will need some more information on your financial situation and you’ll need to complete a full lending application. There are a lot of different factors that go into calculating how much you can borrow for a home loan. We’ve designed our borrowing calculator to be a faster and simpler way to get an estimated answer. Every lender has their own way of calculating borrowing power so you might get different results with other home loan calculators.

We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

Our home loans

The principal of a loan is the remaining balance of the money you borrowed. Principal does not include interest, which is the cost of the loan. Adjust your down payment size to see how much it affects your monthly payment.

Keyboard_arrow_down No Deposit Home Loans Did you know there are at least 6 ways to get a home loan with no deposit? Our brokers can guide you through the options and their lending criteria. Find out if you qualify.85% Home Loan Which lenders have waived the LMI premium for an 85 percent mortgage?

Other tools

Even if you save $200 per month you’ll still end up with $2,400 towards your other goals at the end of the year. Set up separate accounts so you can see the sum of your savings easily. Build up a good savings history – try to develop evidence of a regular savings history before you apply for a home loan.

Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association fees to collectively pay for amenities, maintenance and some insurance. LVR is the amount of your loan compared to the Bank’s valuation of your property offered to secure your loan expressed as a percentage. Home loan rates for new loans are set based on the initial LVR and won’t change during the life of the loan as the LVR changes.

The costs could include strata payments, maintenance expenses, utilities and council rates. Aside from the money for the deposit and lenders mortgage insurance, unfortunately, there are a number of other hidden costs when buying a home. Pay down debts – if you have existing debts like credit cards and personal loans, try to pay these down as much as you can before applying for a home loan. If you have any credit cards that you don’t use, consider paying them off in full and then cancelling them.

You could potentially save by refinancing your current home loan with us. Please note that there are temporary restrictions on our deposit requirements which may mean you will need at least a 20% deposit for an owner-occupied property. If you are looking at selling, buying or refinancing a home, a property valuation helps determine your property’s worth. Proof of your ability to save is vital if you’re buying your first home.

Marc Terrano is a lead publisher and growth marketer at Finder. He has previously worked at Finder as a publisher for frequent flyer points and home loans, and as a writer, podcast host and content marketer. Marc has a Bachelor of Communications from the University of Technology Sydney. He’s passionate about creating honest and simple reviews and comparisons to help everyone get value for money.

Every lender has their own formula for calculating your borrowing power, and they generally look at six main factors. We'll only ask you to provide an estimate of your household expenses once. We ask you to consider your combined expenses, and we won't ask you to provide separate expense estimates for the primary and secondary applicants. We'll ask for this information as the primary applicant is filling in their financial info, and before we ask the secondary applicant to provide their financial info. Use these mortgage calculators to guide you in your home ownership journey. With property prices on the rise, it’s harder than ever for first home buyers to take their first step into the property market.

There are a number no deposit options on the market but they are only available through a few specialist lenders. As a personal loan is possible for high income earners with little existing debt. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans.

However, it may give you some insight into whether or not the amount you were thinking of borrowing could be within the range of what you can afford. Once you get an idea of your mortgage repayments from the calculator, together with the rest of your budget, you'll start to see whether you can realistically afford the home you want to buy. Your local RAMS franchisee can also help guide you through this process.

No comments:

Post a Comment